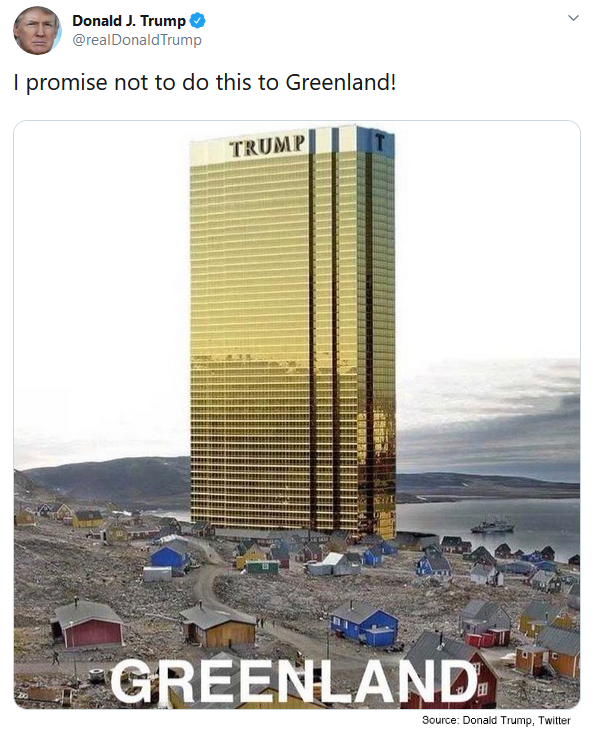

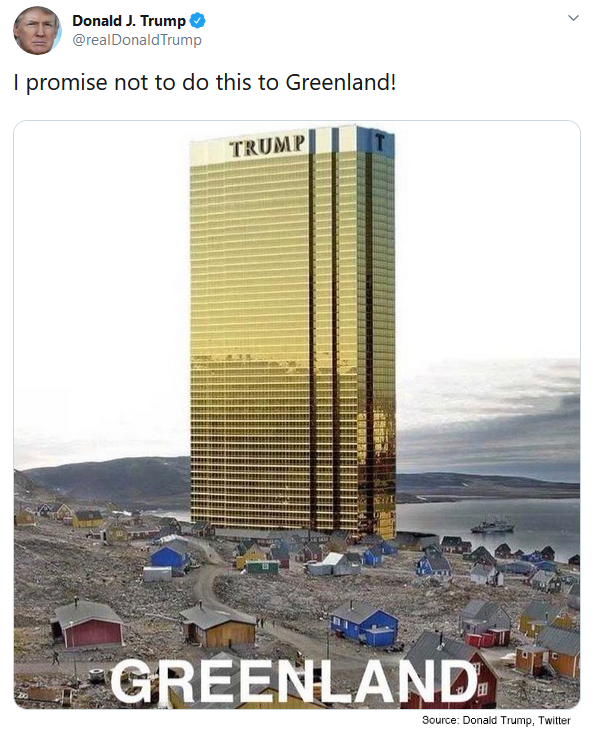

| by Scott Ronalds There's never a dull moment when it comes to President Trump's Twitter feed. Case in point, this post from last week:

And just like that, real estate is in the news again. In what would likely go down as the biggest land deal in history, the President has expressed interest in purchasing the world's largest island, even though it's not for sale. Trump's expression of interest and Twitter tactics have irked the people of Greenland and Denmark (Greenland is an autonomous country of the Kingdom of Denmark). Danish Prime Minister Mette Frederiksen suggested that the idea of buying Greenland was "absurd" and hoped it was a joke, according to a BNN Bloomberg article. The President has pulled back for the time being, but where this all goes is anyone's guess. While musing over the whole thing with a client, she asked me what's a suitable level of exposure to real estate stocks in her investment portfolio. My answer: "It depends, but probably somewhere between 5-10%." It's a bit of a loaded question, as real estate has been a heated topic of discussion in Canada over the past decade and every investor's situation is unique. To be clear, my response referred to a reasonable level of exposure to real estate stocks (emphasis on stocks) in the equity portion of her portfolio and doesn't factor in a principal residence, vacation/investment properties, or land assets she may own. That adds another layer of complexity to the conversation. Suffice to say, if you own significant real estate assets in these forms, it's advisable to make sure any additional exposure in your investment portfolio is measured. For the most part, the asset class has been a solid performer, valuable diversifier, and steady source of income — although some investors may be overexposed if their portfolios are heavy on REITs (real estate investment trusts) and dividend stocks. See Tom's recent Financial Post article for more on the topic. Steadyhand investors have exposure to real estate through most of our funds (our Equity Fund is the only fund that doesn't currently hold any stocks in the sector). Our Income Fund focuses on Canadian REITs, while our equity funds lean more towards companies with a global footprint. Current investments include residential and commercial property owner/operators in Canada (e.g. Allied Properties REIT, Canadian Apartment Properties REIT, First Capital Realty); global developers (Kennedy Wilson, Dream Global REIT, Heiwa Real Estate); and a commercial real estate services company (Cushman & Wakefield). The weighting of real estate-related securities in our funds typically ranges from 4-8%, although it's been both lower and higher at times depending on prevailing opportunities. The Founders Fund currently has a 5% position (in its stock holdings). We think this modest level of exposure is sensible, as real estate investments can also carry risks that we haven't touched on, including liquidity and interest rate risk. The asset class can also be highly susceptible to swings in sentiment. And let's not forget, overdoing it on a specific sector can make any investor red in the face.

Read in browser »

Recent Articles:

|