| Republished courtesy of the National Post

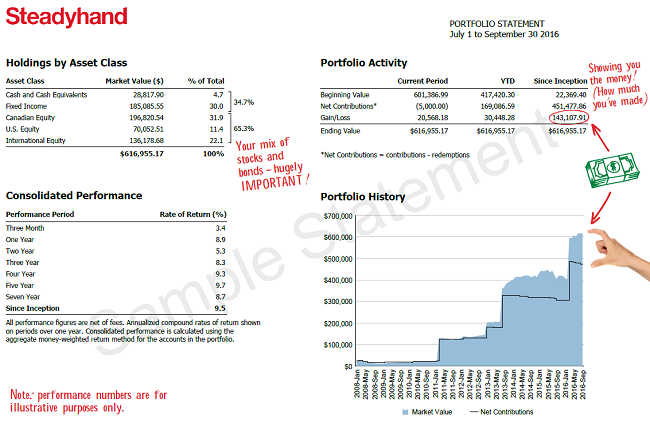

by Tom Bradley Your year-end investment statement will be hitting the mailbox any day now. You'll also be receiving important supplementary information. The Canadian Securities Administrators (CSA) require that investment dealers and counsellors show clients their portfolio returns and fees paid in an Annual Report (which may come separately). This is the best time you'll have all year to assess of how you're doing and whether your provider is delivering the goods. I should point out that Canadian investment firms aren't known for their transparency so you may have to do some digging. If you're receiving the bare minimum, then you should give your advisor or client service representative a nudge. They will be able to provide more information about fees, returns and asset mix. When you have the year-end reports in hand, there are some things to look for. Fees When it comes to costs, the quality and usefulness of the numbers varies between firms. In the Annual Report, dealers are required to show the administration charges, advice fees and sales commissions you paid. They don't, however, have to include management fees and expenses related to any ETFs, mutual funds and structured products you hold. If you're unsure what's included, ask whether you're seeing the total cost. And if your enquiry is met with hesitation, obfuscation, or you're told fees aren't important, ask more questions. You're almost certainly paying too much. Investment Returns Returns for 2018 will be all over the map. A vast majority of investors will be down for the year and in some cases the declines will be severe (if they were on the wrong side of the pot stocks, had too much energy and/or too little foreign exposure). A lucky few will be in positive territory. Keep in mind, individual years are not useful in assessing how you're doing (too short; too random), although last year was more useful than some. With the increased volatility, 2018 was a good indicator of how much risk you have in your portfolio. Ideally, you want to look at returns over a full cycle, which includes bull and bear market periods. In this regard, the Annual Report is getting a little bit more useful every year. That's because the CSA started the clock on January 1st, 2016, which means you'll see at least three-year returns this time. Three years is far from a full cycle, but it's better than just one. A balanced portfolio (50-70% stocks) should have achieved a return in the range of three to five percent per annum after all costs (which equates to a cumulative return of 9-16%). I'm basing this on how the fixed income and equity indexes did over that period. If you've been with your firm for many years, ask for numbers going back to when you started. Ten-year returns to December represent a full market cycle and match up well with your long-term investing goals. Over the last decade, balanced portfolio returns should be in the range of 6-8% per annum (80-120% cumulative). For portfolios that are predominantly invested in stocks, a reasonable range is 8-10%. If you are meaningfully below these levels, you should consider making a change. Asset mix The biggest lever you have for adjusting your level of risk is the type of assets you own. More specifically, the percentage of your portfolio that's invested in stocks, higher risk bonds and real estate compared to more stable fixed income vehicles like GIC's and government bonds. Asset mix is another area where you may need to ask for better information. Many of the statements I see break down accounts into cash, bonds, stocks and mutual funds. Funds, of course, are convenient vehicles for owning cash, bonds and stocks, they are not an asset class. If you have a good portion of your portfolio in mutual funds, this breakdown is of no use. Again, ask your advisor to put all your accounts together (RRSPs; TFSAs; and other accounts) and calculate an asset mix taking into account the funds you own. This year you may be reluctant to open your statements given how badly 2018 finished, but I encourage you to at least look at the Annual Report and make sure you understand it. You can't assess how you're doing unless you do.

Read in browser »

Recent Articles:

|