|

Republished courtesy of the National Post

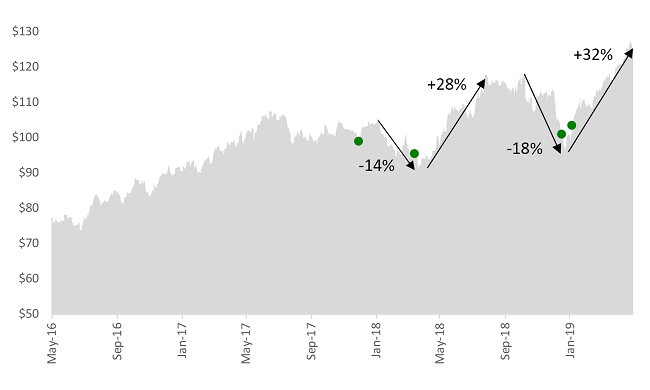

by Tom Bradley When stock markets are hitting new highs, there always seem to be more articles on downside protection. Which stocks will hold up when the rocket ride ends? Is there an industry that does better in tough times? Are ETFs a good place to hide? There might be a stock or industry that does better but, short of timing the market and selling everything, a portfolio that's designed to grow with the markets will also retreat with the markets. There are no free lunches in investing. There is one strategy, however, that comes close. By owning a broad mix of assets, you can smooth out your returns and eliminate the risk of permanent capital loss, without meaningfully reducing your long-term growth. Diversification doesn't eliminate the downside, but it softens the blows and ensures that you'll recover. David Swensen, chief investment officer at Yale University, puts it this way in his book, Unconventional Success: "Diversification demands that each asset class receive a weighting large enough to matter, but small enough not to matter too much." Building wealth Every investor should be diversified, but not for the same reasons. For those who are building their wealth and have an emphasis on growth, the primary reason is to avoid a permanent loss of capital. A smoother ride feels nice, but isn't necessary. Indeed, accumulators should celebrate when stocks are down. They're buyers, not sellers. But a significant hit to capital can put a dint in even the longest retirement plan. It's harder to recover if your portfolio goes off the rails because it's focused on one type of stock (i.e. technology, cannabis, banks) or perhaps real estate in one city. Spending your money Retired investors don't want to impair their capital either, but they also have to care about volatility. They're drawing a paychecque from their portfolio and don't want to sell when prices are down. For this reason, de-accumulators need to go beyond stocks and hold other asset classes like cash, GICs and bonds for stability and income. Unfortunately, it's in this area where portfolios are less diversified today. I say that because they're holding fewer government bonds which are the most reliable diversifier there is. When stocks are in freefall, you can be assured that interest rates are dropping and therefore, the value of government bonds is increasing. When stocks melted down in 2008, government bonds went up in price as they did during the downdrafts in 2011, 2016 and 2018 (Note: Cash and GICs also held their value but didn't appreciate). Extremely low interest rates are prompting investors to look for securities and funds that carry a higher yield. In lieu of GICs and government bonds, they're holding riskier fixed-income securities, preferred shares and even dividend-paying stocks such as banks, utilities and REITs. These are all valid investments and play a role in our portfolios, but they don't provide the same diversification. Take high-yield bonds for instance. In an economic slowdown when government bonds are rising, junk bonds (as they're known) are likely going the other way. In uncertain times, buyers demand a higher yield on riskier assets, which pushes prices down. Historically, high-yield bonds have performed more in line with the stock market than the bond market. Dividend stocks are even more closely linked to the stock market. They're stocks after all. Unpredictable diversification To fill the gap, there's a growing number of exotic products that claim to have low correlation to stocks. In other words, their price movement isn't linked to what the stock market is doing. These 'absolute return' funds focus on generating a positive return by using a number of hedge fund strategies including shorting and arbitrage. But there's a catch (beyond their high fees). The relationship to stocks is unpredictable. A fund might perform well in a market swoon, but it might not. These products provide what I call "unpredictable diversification." Swensen says that if you're holding bonds for the purpose of diversification, they should only be government bonds. I won't go that far but, suffice to say, being measured and balanced is important. When you give up on high quality bonds and GICs in search of higher yield, know that you're playing offence, not defence.

Read in browser »

Recent Articles:

|