|

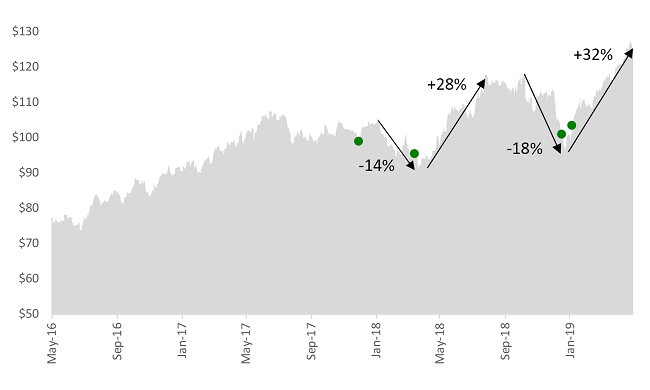

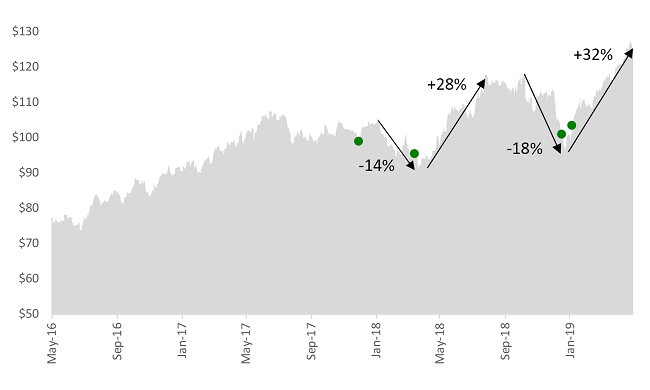

by Scott Ronalds Stock markets tend to move up and to the right over long periods of time. In the shorter term, the path is much bumpier. Understandably, this can be a turn off for many people. The fact that a company's value can be pulled in any direction based on the mood of investors, rather than the fundamentals of the business itself, is a concept that can be hard to grasp. But such is the perverse nature of investing. Frequently, these near-term moves have little to do with the underlying operations of a company and more to do with external factors that may have little impact on its long-term fortunes — things like economic headlines, market forecasts, and geopolitical actions. Indeed, while a company's stock price may gyrate significantly over a month, quarter or year, nothing may have changed within the company itself or with respect to its prospects. As your steady hand, it's our job to see through these price undulations and focus on the long-term prospects of a company. And importantly, we seek to take advantage of temporary mis-pricings where we can. Let me show you what I mean. CN Rail is a great Canadian company that we've owned for over seven years in our Equity Fund. CN is one of North America's leading railroads, with a network that spans from Halifax to Vancouver and south to the Gulf of Mexico. It transports more than $250 billion worth of goods annually for businesses in a diverse range of industries. The company has grown its revenues and earnings steadily over the past decade and has raised its dividend every year since its IPO in 1995. The stock has been a solid investment for us, doubling in value over the past five years. It hasn't always been a smooth ride though (pardon the pun). Over the past few years, the stock has dropped more than 10% on three separate occasions. And in the fourth quarter of 2018, it declined nearly 20%. Why the steep fall? Did the value of CN's physical assets fall by one-fifth? Did it suffer a sharp drop in sales? Was it involved in a scandal? No. In fact, there were no material changes to the business itself during this recent decline. Investors were simply in a fearful mood and were selling stocks across the board. Sure enough, CN rebounded more than 30% following the selloff late last year. Stock Price: CN Rail

Our manager (Fiera Capital) saw this volatility as an opportunity to buy shares in a great company that was on sale. Once confirming that the business was still on solid footing, they bought additional shares in the stock as they felt the price didn't reflect the company's value (they bought shares during previous downturns as well, as indicated by the green circles on the chart). This is just one example of how stock prices are fickle. They'll move above and below a company's real value in the short term (albeit, a subjective measure), but over the long run they tend to more accurately reflect a business's worth. A key to successful investing is to not overreact to these swings. Easier said than done.

Read in browser »

Recent Articles:

|